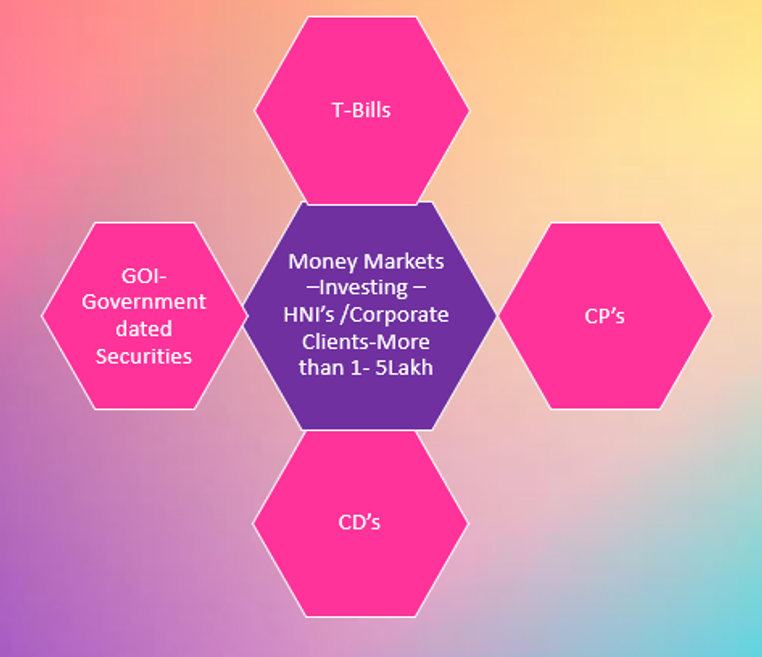

The money market refers to the sector of the financial markets where short-term borrowing and lending occur, typically for instruments with maturities of one year or less. It is a crucial part of the financial system because it provides liquidity for the global economy, enabling institutions, companies, and governments to manage their short-term funding needs.

Money market instruments are typically low-risk, highly liquid securities, making them an attractive choice for investors seeking safety and stability. These instruments are generally traded in large volumes, and their short-term nature means they are sensitive to interest rate changes.

Financial Awareness on

Investments and Trading

Stock Markets

Copyright © 2025 Love Finance.